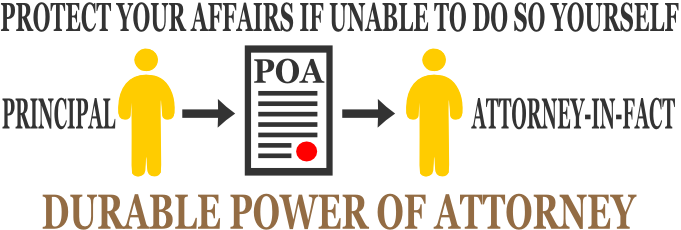

A Power of Attorney is a legal document giving someone that you select the authority to act in your place if you cannot do so.

A General Power of Attorney gives your agent or attorney-in-fact the power to handle your financial and business affairs. But what happens if you become incapacitated or disabled? A General Power of Attorney terminates immediately if you are mentally incapacitated or disabled.

What is a Durable Power of Attorney?

You must use a Durable Power of Attorney if you become mentally incapacitated or disabled. A Durable Power of Attorney is not affected by the principal’s health.

Fill out and print a free Durable Power of Attorney form in just minutes online.

In order to ensure that your medical treatment and financial affairs are handled the way you want them to be in case you become mentally incapacitated, you need to name someone to be your Durable Power of Attorney – a trusted individual to act on your behalf. A Durable Power of Attorney only becomes invalid if you pass away.

Why do I Need a Durable Power of Attorney?

Every day, we hear of traumatic brain injuries from seemingly benign incidents, cases of meningitis or a swift onset of Alzheimer’s. You never know what life may bring, and your family and loved ones may find themselves trying to battle the courts on top of figuring out how you want your financial and medical decisions made – all while managing the stress of your condition.

A Durable Power of Attorney form ensures that your medical and financial matters are dealt with as you specify, and it places the powers with trusted individuals who can carry out your wishes. Your Financial Durable Power of Attorney and Medical Durable Power of Attorney might be the same person, but it doesn’t have to be.

Financial Durable Power of Attorney Form

For example, you might pick a financial adviser or trustee who doesn’t need to know the specifics of your medical care. He or she might then be responsible for:

- Handling your financial assets including cash, investments, retirement accounts, trusts and more

- Who benefits from which financial assets

- When beneficiaries are provided with specified financial assets

With a Financial Durable Power of Attorney your attorney-in-fact might also take care of investment account changes, file your taxes and access safety deposit boxes.

Medical Durable Power of Attorney Form

A Medical Durable Power of Attorney, on the other hand, will oversee your medical treatment and make health care decisions on your behalf. You may have heard of Medical Durable Power of Attorney referred to as your agent or health care proxy.

If you become mentally incapacitated, your Medical Durable Power of Attorney is legally required to abide by your treatment preferences, as long as he or she knows what those preferences are.

To make it easier on your Medical Durable Power of Attorney, you might want to consider preparing a living will – often referred to as an Advance Directive. This written legal document provides health care instructions to your Medical Durable Power of Attorney about how you want to proceed. This can be as broad or as detailed as you would like.

Essentially, a Durable Power of Attorney has the right to act on your behalf if you are mentally incapacitated and cannot make these decisions for yourself. It can be a way to protect your family and ensure that your loved ones are provided for.

Fill out and print a free Durable Power of Attorney form in just minutes online.